Considering a consolidation? There are many benefits to this decision. Some people find it easier to manage all of their bills with a single monthly payment, while others like the option of lower interest rates and alternative repayment plans. But what are the disadvantages of combining loans? Here’s a quick guide. The benefits of consolidation include lower interest rates, simplified payments, and the ability to lock in the current interest rate.

Convenience of having just one loan with one monthly payment

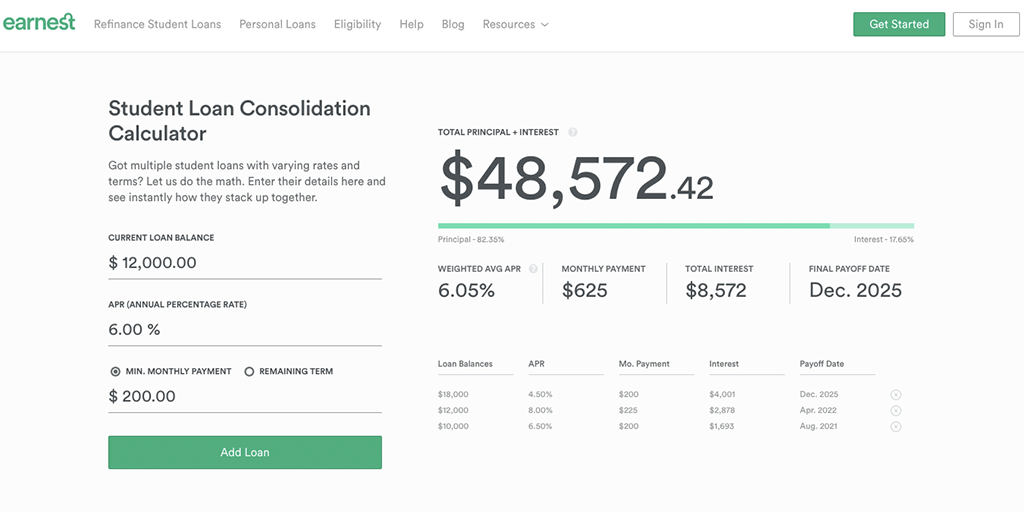

When you have multiple loans, it is often easier to make one large payment. By consolidating all your loans into a single one, you will have just one monthly payment and can enjoy a fixed interest rate. You can also lengthen the repayment period and lower your monthly payment. The drawback to consolidation is that you will likely pay more interest overall over the life of the loan. If you have multiple loans, you should carefully consider the benefits of consolidating them.

Consolidation is the process of combining multiple federal student loans into a single loan with one monthly payment. This method can also save you money on stamps and time. Consolidating multiple loans into one also allows you to qualify for income-based repayment plans. And if you don’t qualify for this program, you can always opt to apply for a private loan. But if you don’t qualify for the income-based repayment plan, you can try consolidating federal student loans to keep yourself eligible for it.

Lower interest rates

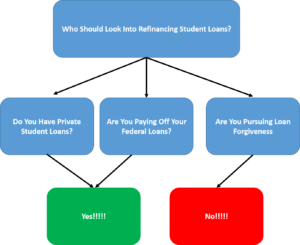

If you have a lower income, consolidating federal student loans may be your best option. Federal student loans typically offer lower interest rates than private loans, and they are often available with income-based payment plans. Consolidation may also make more sense if you need to extend your loan term or face decreasing income. Regardless of why you are consolidating, you may want to consider refinancing later with a private lender. The process is free, and you could end up with a lower interest rate.

While you may have a lower interest rate when consolidating federal student loans, it is important to know that the rounded-up interest rate on your new loan is the average of all of your previous loans. This rate will be higher than your lowest and highest interest rates, so it is important to contact your lenders to find out what their current rates are. In addition, consolidating while you are in a grace period may result in higher interest rates and longer repayment terms.

Alternative repayment plans

There are four main types of repayment plans for federal student loans: the standard repayment, the extended repayment, the graduated plan, and the fixed plan. The standard repayment plan requires you to make a fixed payment each month for ten years. The alternative repayment plans vary in monthly payment amounts and length, but all have one thing in common: you pay less in interest than in the standard repayment plan, and you get to extend the loan term.

The income-driven plan is the best alternative to deferment and forbearance. While it can seem complicated, it is a far better option than neither. Learn more about this alternative. With a little research, you’ll be on your way to paying off your federal student loans. You’ll be glad you did. Regardless of the method you choose, you should always speak with a financial aid professional to find out what plan is best for you.

Loss of borrower-friendly benefits

One of the main benefits of consolidating your federal student loans is that you will have one payment each month instead of multiple ones. Consolidation also makes your loan repayment more manageable by giving you a longer payment period. However, this benefit does come at a cost: the total cost of your consolidation loan will be higher than the total amount of your old loans. The consolidation loan also resets the clock for deferments and forbearances. Because you will have a longer payment period, you will end up paying more interest over the life of your consolidation loan.

Another disadvantage of federal loan consolidation is that you lose some of the borrower-friendly benefits of the federal program. For example, a grace period of six months is required to repay a federal student loan. However, federal loans have different rules than private loans. This means that, for example, a student graduating in May will not begin repaying until November. During this time, the interest accrues, so payments on your PSLF will not begin until November.