In this article, we’ll discuss why you should consider consolidation over repaying multiple lenders. Ultimately, consolidation is better for borrowers with good credit, since it reduces your monthly payments and lowers your interest. But if you have bad credit, private consolidation might be the better choice for you. Fortunately, private consolidation is possible as well, but it’s a completely different process. If you’d like to consolidate your student loans yourself, there are some steps you can take to avoid the hassle and delay.

Consolidation is cheaper than paying back multiple lenders

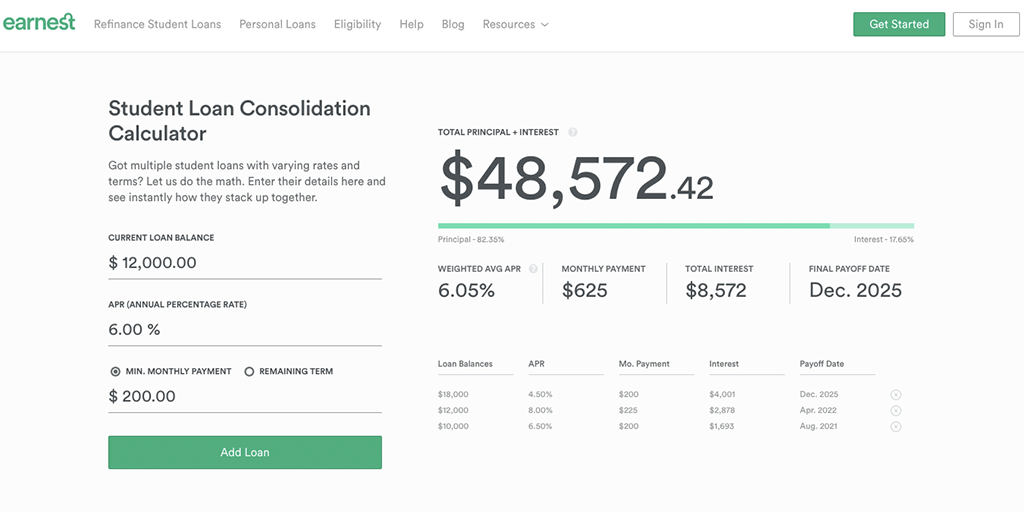

When you combine all of your loans into a single loan, you will pay a lower interest rate on the new loan. A consolidation loan usually has a fixed interest rate, but it’s important to note that a lower interest rate can also be a “teaser” rate, meaning it will change to a higher APR after the introductory period is over. This will cost you more money in the long run. Using a debt consolidation calculator can help you find the best option for your circumstances.

It lowers monthly payments

Many people choose to consolidate their student loans to reduce monthly payments. In many cases, this will reduce the total cost of the loan, lower the monthly payment, and simplify payments. Other times, a loan consolidation will lower the interest rate or extend the repayment period. These benefits may make consolidation the best choice for those looking to reduce their monthly payments. But whether consolidation is right for you depends on your personal situation. Read on to learn more about the pros and cons of combining student loans.

It reduces interest over the long term

Many people think that consolidating student loans will lower their interest rates, but this isn’t necessarily true. Although some consolidation plans offer a lower monthly payment, the actual effect is usually a slightly higher interest rate over the lifetime of the loan. Depending on the interest rate, consolidation may reduce the amount of interest you pay by as much as 50% or more. The cost of a consolidation loan can be low compared to the costs of a variety of other debts.

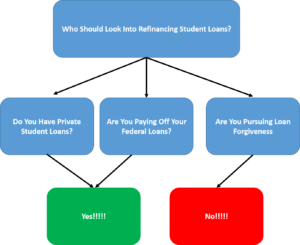

It is better for borrowers with good credit

When you consolidate your student loans, you’ll have one lower monthly payment and one fixed interest rate. Not only will this lower your payment, but it will also reduce your debt-to-income ratio, which makes you more attractive to creditors. Additionally, lower monthly payments also boost your credit score. Considering these advantages, you might want to consolidate your student loans today. Listed below are some of the benefits of debt consolidation.

It causes you to lose military benefits

If you’ve consolidated your student loans, you may be causing yourself to lose military benefits. The government uses a data matching process to identify military members and apply a waiver for federal student loans. It should automatically apply to your account, but if you feel that you were passed over, contact your servicer. He or she can try to throw out any interest charges retroactively. But be aware that this is not always the case.