If you are wondering “How do I consolidate my student loans?” you’re not alone. Many borrowers are confused about the different options available, including Refinancing, Income-driven repayment plans, and Grace periods. In this article, we’ll discuss what you can do to avoid these pitfalls. Also, we’ll discuss what’s involved in the process. The best way to choose a consolidation plan is to speak with an education loan counselor.

Refinancing

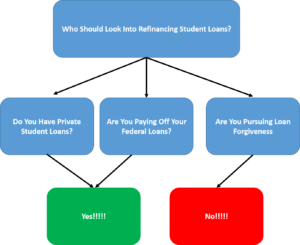

Refinancing student loans is a popular way to reduce the monthly payments while simultaneously getting a lower interest rate. It may also allow you to take out a more aggressive payment plan. However, refinancing is not without its disadvantages. Select breaks down the benefits and disadvantages of refinancing student loans below. It can help you decide whether it is the right option for you. There are also many factors to consider before refinancing your student loans.

While refinancing is generally the better option for people with stable income and a high credit score, it is not always the best option. Federal student loan refinancing has many disadvantages, including the loss of many benefits such as administrative forbearance and loan forgiveness. If you are eligible for both options, you should compare your options. The benefits of refinancing student loans depend on your individual circumstances.

Income-driven repayment plans

If you are in the process of consolidating student loans, consider an income-driven repayment plan. These repayment plans have a cap on the amount you can pay per month based on your income and family size. They include the Income-Based Repayment, the Pay As You Earn, and the Revised Pay As You Earn plans. Generally, borrowers must first get out of default to qualify for an income-driven repayment plan.

To qualify, you must prove that you have been experiencing partial financial hardship for at least the past year. For this, you must meet certain income requirements based on your family size, adjusted gross income, and state of residence. If your income exceeds these levels, you may qualify for an income-driven repayment plan. Generally, you can expect to pay ten or fifteen percent of your discretionary income each month. Income-driven repayment plans can last for twenty or 25 years. But be aware that you may not qualify for one if you have a Consolidation Loan or Parent PLUS loan.

Grace period

There are two options for borrowers who want to pay off their student loans during the grace period: refinancing or applying for consolidation. While refinancing may be a good option for those who can afford the higher interest rates, some people find it difficult to manage multiple monthly payments. In those cases, refinancing is the best option. In addition, it can save people hundreds of dollars a month and thousands of dollars over the life of the loan.

During this period, a new employee may be eligible to enroll in a loan repayment assistance program offered by his or her new employer. A new employee should take advantage of this option as soon as he or she becomes eligible. However, some people may want to wait until the end of the grace period to make their payments. That way, they can prepare themselves before the due date. In addition, this time will help them start rebuilding their financial lives and avoid falling further behind on their loan payments.

Repayment options

Repayment options for student loans depend on your income and repayment ability. Income-based plans can help lower your monthly payments by setting them at a percentage of your discretionary income. If you can make the payments on time for at least 20 years, you can also apply for a loan forgiveness. In some cases, you may qualify for this type of plan even if you are earning more than the required minimum amount. But it’s important to note that the forgiven amount will be taxable.

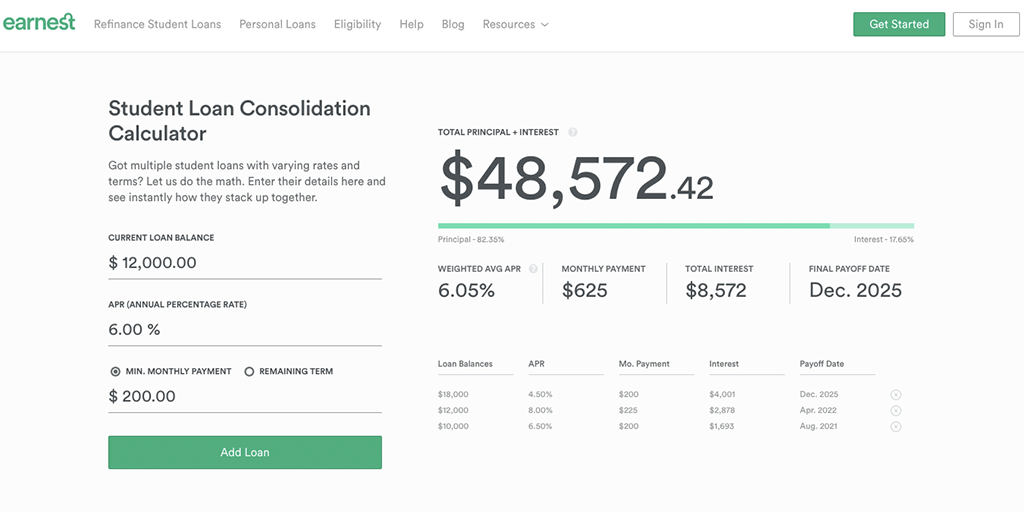

In addition to the standard repayment plan, you may also wish to choose a loan consolidation or extended repayment plan. Refinancing a student loan may be beneficial if interest rates are low. However, be aware that you might have to give up other essentials to pay for this option. If you have a lot of debt, you may consider consolidating your loans and extending the repayment terms. Be sure to analyze your situation carefully.