When you are trying to make monthly payments on multiple loans, you may wonder how do you consolidate student loans. The good news is that consolidation loans only need to be done once. Additionally, student loan consolidation locks in the interest rates for the life of the loan. For those who are having trouble keeping track of several loan servicers and repayment dates, consolidating your finances can make your life much simpler. For example, the Direct Loan Consolidation program allows you to choose an income-based repayment plan, which can result in lower monthly payments.

Federal student loan consolidation

If you are considering consolidating your Federal student loans, you may be wondering how the consolidation process works. You will need to provide your education loan records and personal income information. Fortunately, federal student loan consolidation forms are available online. Additionally, you must find two references who have known you for at least three years, such as your parents or legal guardians. The first part of the loan application will ask you to choose which loans you want to consolidate and calculate the total new loan amount. The second section will allow you to choose the loan servicer you wish to work with.

The repayment options for federal student loans vary by type and financial status. The repayment section will use your income, tax status, and family size to estimate your monthly payments. Once you have estimated your payments, you’ll need to select a repayment plan. There are a number of benefits and disadvantages of each option. Make sure you choose the right option for your unique situation. This will help you manage your debt more efficiently. By following these steps, you’ll be able to consolidate and simplify your payments.

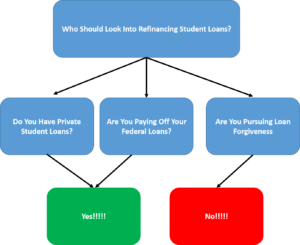

Private student loan consolidation

Getting a private student loan consolidation can be advantageous for several reasons. For one, it can lower your interest rates. Second, it releases your cosigner from the debt he or she was responsible for. Third, if you had a cosigner for your loans, getting a private student loan consolidation can lower your debt-to-income ratio and increase your chances of qualifying for a new loan. And fourth, if you are thinking of switching lenders, private student loan consolidation can give you the flexibility to do so.

Moreover, a private student loan consolidation can lower your monthly payment, which is always advantageous. Even a small reduction can help you save thousands over the life of your loan. And, finally, a private student loan consolidation can lower your debt-to-income ratio, which is the ratio of your monthly income to your monthly payments. Lowering your student loan payment means you have more money for other bills. And, the process of repaying a loan is a lot easier if you don’t have to pay interest rates.

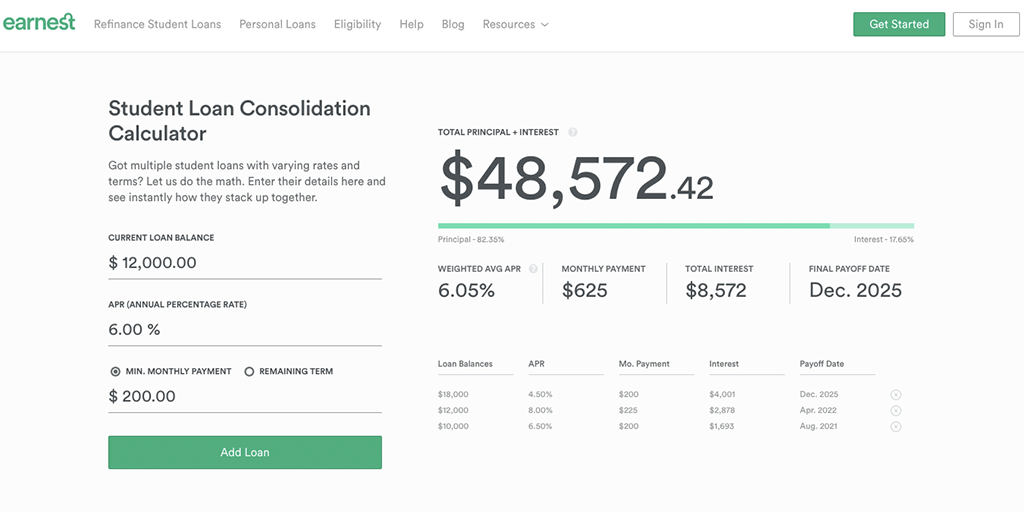

Interest rates on consolidation loans

When consolidating student loans, it is important to know the different types of interest rates and fees that are involved. The Department of Education Loan Simulator can help you compare consolidation plans. The lower the APR, the better. While this is a good way to save money, remember that consolidation is not always the best option. If you have trouble making payments on your current loans, consider consolidating your loans through the federal government’s Direct Loan Consolidation program. This will give you more flexible repayment options and a lower monthly payment.

While some people will claim that they can qualify for lower interest rates by consolidating their loans, there are no guarantees. While you may get a lower interest rate by consolidating your loans, the weighted average will likely be higher than the lowest or highest. Therefore, the total amount of interest you pay over the life of your loans will remain the same. Another benefit of consolidating your student loans is the fact that there are no fees or hidden fees.

Alternative repayment plans besides standard ten-year repayment

Federal student loans have several repayment plans. The default plan, called the standard repayment plan, requires borrowers to make 120 equal monthly payments over ten years. The only difference between this plan and the other plans is that you’ll pay less interest over the lifetime of your loan. But if you are struggling to make your monthly payments and you’d like to have flexibility with your repayment plan, there are several other options available.

If you can afford it, an income-driven repayment plan will increase your payments each month based on your income. However, this plan does not offer loan forgiveness and requires you to pay off your entire loan by the end of the repayment term. You’ll need to re-certify your income and family size each year to qualify for this plan, and if you’re living paycheck to paycheck, an income-driven repayment plan is a good choice.