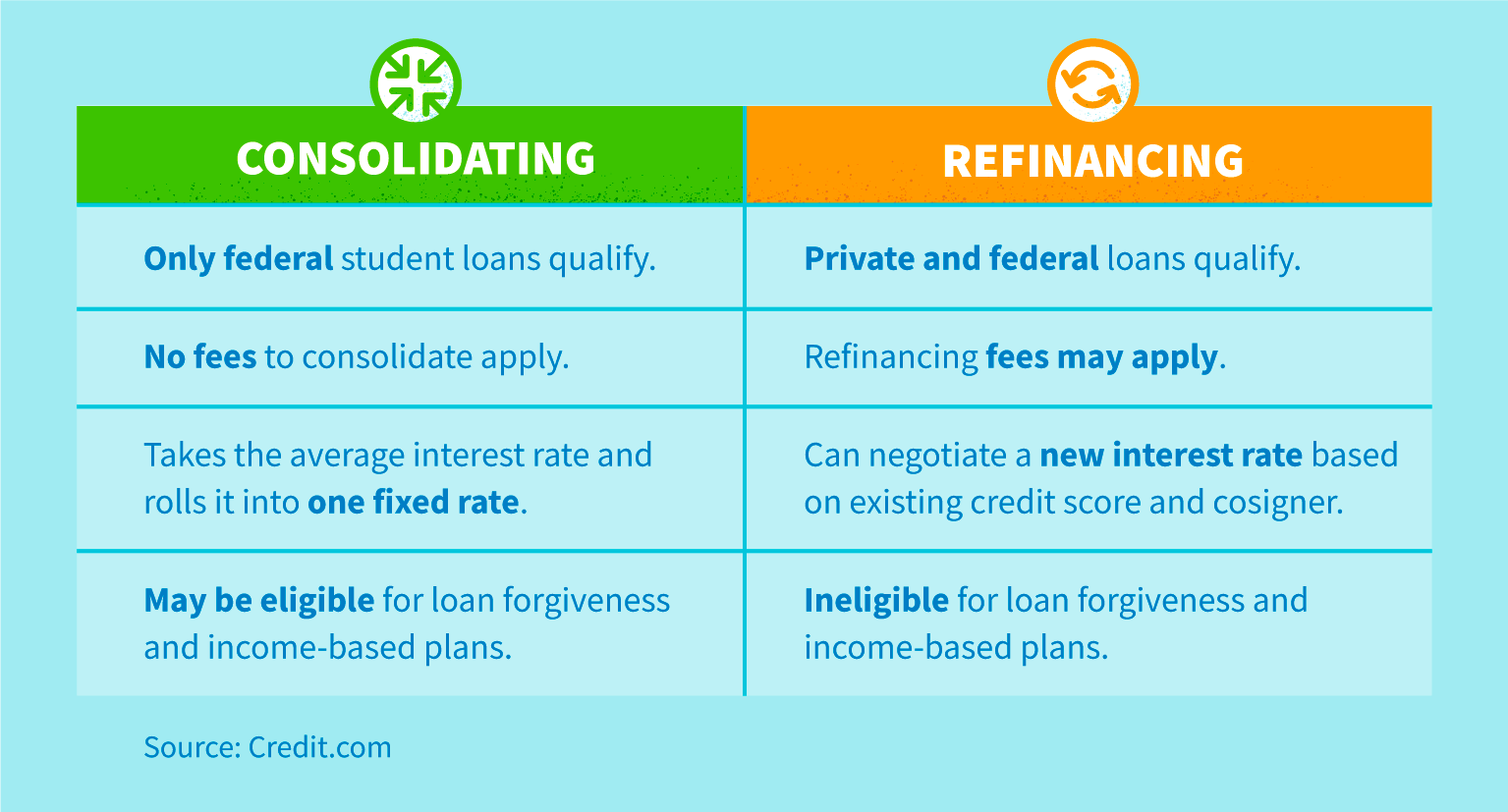

If you’re wondering how to consolidate private student loans, you’ve come to the right place. Here you will learn about the benefits and disadvantages of this type of refinancing. This type of refinancing involves a credit check and the possibility of origination fees, which many private lenders do not waive. While you might be able to save money on interest, you will be losing some federal protections.

Problems with consolidating private student loans

When it comes to private student loan consolidation, there are a few problems to watch out for. While the federal government offers loan consolidation programs, private lenders often don’t have the best reputation for customer service. In fact, according to a report from Forbes, more than half of all student loan complaints are related to federal loans. The good news is that there are ways to avoid these pitfalls, and many private lenders do offer such programs.

One of the most common problems with private student loan consolidation is that the consolidation process forces you to reapply for interest rate deductions, which may not be necessary. Consolidating your loans will also extend your repayment term, resulting in a higher loan balance. While a lower monthly payment is convenient, the longer repayment period means that more interest is accruing. Therefore, if you are unable to make your monthly payments on time, switching to a different repayment plan may be worth considering.

Alternatives to consolidating private student loans

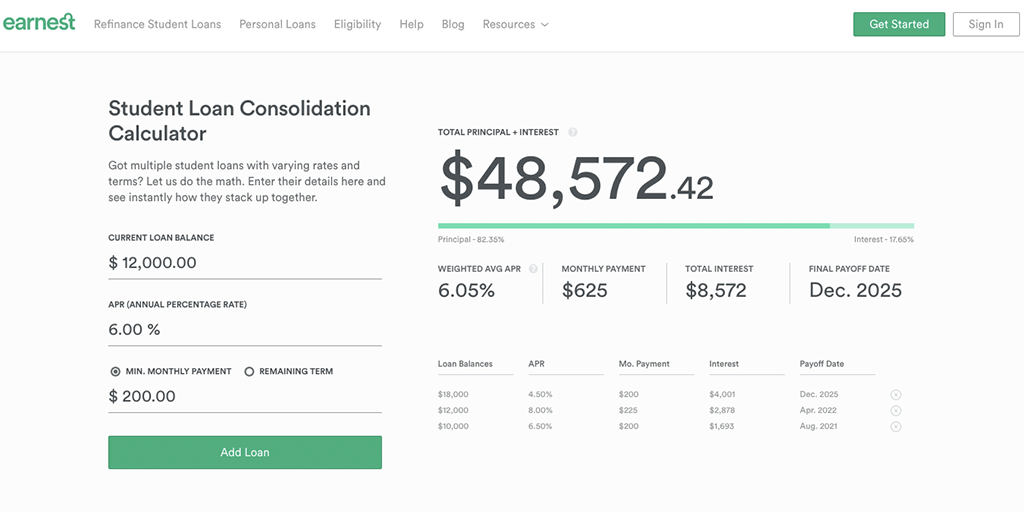

If you’re in the process of repaying multiple student loans, consider a consolidation loan. While private student loans are often unsecured, they may be better suited for consolidation. By consolidating all of your loans into one, you’ll be able to make one payment each month and reduce your overall interest costs. You may even be able to choose a lower interest rate than you currently have. Depending on your credit history, private consolidation may be your best bet.

There are many private student loan consolidation options available. Each provider offers different rates and repayment options. Some require a co-signer. However, this option may be right for you if your credit score has improved significantly. Other options include obtaining a home equity loan or a variable interest rate loan. If your credit score is still low, you may have trouble qualifying for private student loan consolidation. If you do qualify, you can try applying with a local credit union, as their requirements are typically softer than those of a traditional lender.

Benefits of consolidating private student loans

Among the numerous benefits of consolidating private student loans is the reduction of monthly payments. By reducing the number of monthly payments, the average borrower can save $400 per year or $6,000 over the course of a student loan. With only one bill to worry about each month, private student loan consolidation will help reduce monthly payments and lower the debt-to-income ratio, which measures your income against the number of monthly debt payments. In other words, lowering your student loan payment will result in more money coming in every month to pay for bills.

Another benefit of consolidating private student loans is a lower interest rate. Since private student loans are often variable, the interest rate will depend on the borrower’s credit score. With a low interest rate, private consolidation can save borrowers thousands of dollars over the course of the loan. But make sure to research private loan consolidation carefully. Some pros and cons of private consolidation can be found in the following sections. In addition to saving money each month, private consolidation may also provide some major perks.

Alternatives to refinancing private student loans

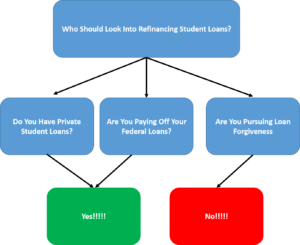

Students who have graduated and are now working can consider refinancing their private student loans. Refinancing requires proof of income and can occur several months ahead of a higher salary. This option is not suitable for students looking for loan forgiveness, as they will need to demonstrate their ability to make a large enough monthly payment. Typically, private student loan refinancing requires a low interest rate, and graduates may find better deals if they are working in the private sector.

However, there are several benefits of private student loans. Federal student loan forgiveness programs are available, but most private lenders do not offer this type of benefit. In some cases, you can qualify for a deferment due to unemployment or economic hardship. Alternatively, you can choose to make interest-only payments until the repayment term begins. However, be sure to ask about your lender’s specific terms and conditions before refinancing.