When can you consolidate student loans? There are a few factors that will determine your eligibility for this loan type. First of all, your interest rate will be fixed. Second, there are no origination fees. Third, you won’t need to follow an income-driven repayment plan. Finally, your loan consolidation opportunity is only available to you once. But don’t let that stop you from pursuing this option. Continue reading to learn more about how to consolidate student loans.

Interest rates for consolidation loans are fixed

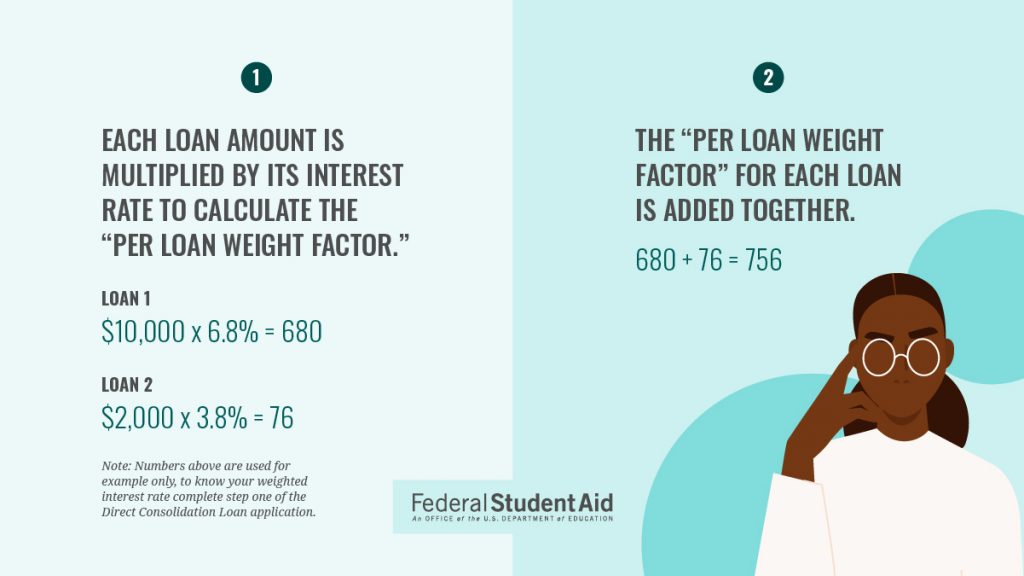

The interest rate you pay on a consolidation loan will be the weighted average of all your loans, rounded up to the nearest 1/8 percent. This interest rate will be fixed throughout the life of the loan. While you may think you’ll get a lower interest rate, it won’t actually be lower compared to the other loans you’ve consolidated. In reality, your rate will increase slightly when you extend the repayment term.

There are no origination fees

A student loan consolidation is a process in which the new lender pays off the previous loan and issues a new one. The new loan has a lower interest rate, but the term of the new loan may be longer, so a ten-year loan could now be thirty years long. Although a student loan consolidation will lower monthly payments, the long term may not make sense since the principal stays the same and the interest rates are likely to increase. To qualify for a consolidation loan, you must have graduated, dropped below half-time student status, or left school.

There is no income-driven repayment plan

Whether you’re married or not, you’ve probably wondered if there’s an income-driven repayment plan for student loans. Typically, this type of plan locks you into a certain plan until you recertify your income each year. If you fail to recertify your income each year, your loan payment can increase dramatically. A joint return calculates your payments based on your combined income, which means your monthly payment will be much higher than before.

There is only one chance to consolidate student loans

There are several benefits of consolidating your student loans. For one, you will pay one monthly payment, and your interest rate will stay fixed. Additionally, by extending the repayment term, you will lower your monthly payments and avoid default. With consolidation, you will have only one chance to use these benefits. This article will discuss some of these benefits. Moreover, you will also learn how to consolidate student loans without affecting your credit score.

There are no military service requirements to consolidate student loans

Many states have programs to help military members pay off their student loans. Some states require schools to give service members tuition credits or refunds. In fact, the Consumer Financial Protection Bureau recently released a report on student loan servicing issues involving active duty service members. The bureau also published a servicemembers’ student loan guide to help them manage their loans. There are also specific programs to help veterans pay off their student loans. More information on military education can be found at Veterans Education Success and the Consumer Financial Protection Bureau.