You might be asking: Can you consolidate private student loans? Here are some things to consider. Read on to learn about Repayment options, Interest rates, and refinancing. If you are looking for a loan with lower interest, you may want to consider a private lender. Listed below are the benefits and disadvantages of private loans. Also, find out how to apply for consolidation. Also, consider a private lender if you’re not sure if you’ll be able to repay the new loan.

Benefits

The advantages of consolidating private student loans include the ability to lower monthly payments. Refinancing student loans can also result in lower interest rates and shorter repayment terms. In addition, borrowers with good credit can enjoy a lower interest rate and shorter repayment terms. Ultimately, the benefits of consolidating private student loans can make them worth the process for many borrowers. To learn more, read on! Listed below are three of the top reasons to consolidate private student loans.

Repayment options

Repayment options for private student loans typically begin after borrowers graduate and complete their grace period, which is usually six months. Once borrowers start making payments, they will be on a standard repayment schedule, which is a plan that puts them on track to repay their loan in ten years or less, depending on the balance. These repayment plans usually offer more flexible payment options, such as deferred payments. However, you should keep in mind that the shorter the repayment term, the lower your interest rate.

Interest rates

One benefit of private student loan consolidation is the new interest rate. Instead of paying off multiple lenders with a high interest rate, you only need to worry about making one payment. The new interest rate is based on the average of all the existing rates. The lower the new rate, the lower the monthly payment. In addition, you may be able to change the repayment terms or get a fixed interest rate instead of a variable rate.

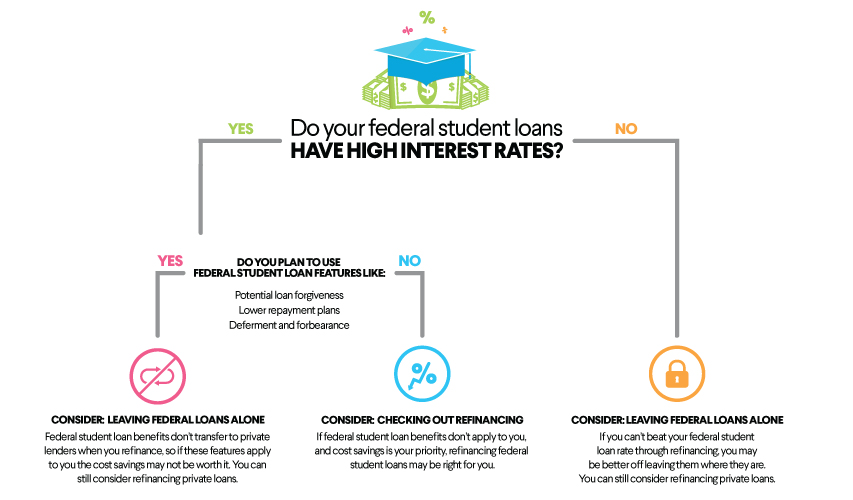

Refinancing options

There are several options for refinancing private student loans. Most private lenders offer fixed interest rates or variable rates. By adjusting the interest rate or length of the loan, borrowers can reduce the amount of money they pay each month. Longer terms, however, almost always increase the total amount of interest. As a result, refinancing may not be the best option for students with poor credit.

Cost

Before you choose to consolidate your private student loans, you must consider the cost of refinancing. You can do this by using the Department of Education’s Loan Simulator. By comparing the different offers, you can compare interest rates, fees, and other aspects of the loan. In general, the lower the APR, the better. However, some borrowers may find that refinancing is their best option.