If you have more than one loan, you might be wondering: can you consolidate student loans with your spouse? It depends on a number of factors, including whether you graduated from an accredited college and have a regular monthly income. Some lenders also require a certain loan balance or the number of on-time student loan payments. If you are interested in consolidating your loans with your spouse, you should first learn more about the process.

Requirements to consolidate student loans with your spouse

There are certain conditions you have to meet in order to consolidate student loans with your spouse. The first is that you must be married. If you were married when you took out the loans, it means that your loan was jointly incurred. If your spouse died, the debt will fall on the surviving spouse. But if your spouse passed away while you were still living, it would be a relief to get rid of the debt.

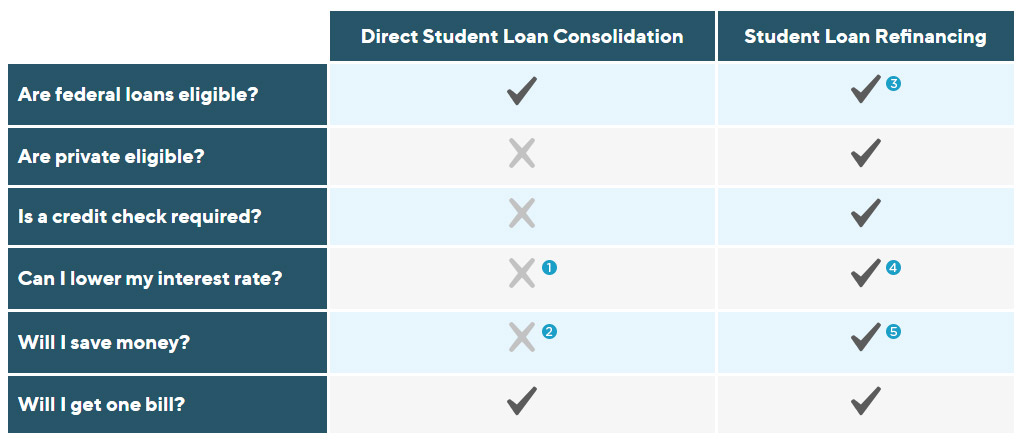

Another condition is that you must have a steady monthly income and credit history. A federal student loan is a good example of this. Refinancing can result in you losing the benefits of a loan forgiveness program. You can’t combine two federal loans, so you should keep that in mind as well. A private lender will most likely not offer you any of those programs. But you’ll still need to have a good credit score and have a steady income.

Benefits of consolidating student loans with your spouse

There are many benefits to merging your finances with your spouse, from easier repayment to better credit scores. If your marriage has helped you to achieve a higher income, you might be able to take advantage of a student loan consolidation program to reduce your monthly payments. However, if you are not sure whether this option is right for you, consider some of the factors to consider before committing to this option.

Refinancing can also be advantageous in some cases. By having just one loan, you can lower your monthly payments by as much as 20%. The longer repayment terms may mean higher interest, but they can be worth it in the long run. If you are concerned about missing a payment, consider switching to a longer-term loan. If you miss a payment, you may not have the money to pay for essentials or save for retirement. In such situations, consolidating your student loans with your spouse can make budgeting easier.

Steps to consolidating student loans with your spouse

If you are married and you are weighing the options for consolidating student loans, you may want to consider the benefits and drawbacks of spousal loan consolidation. The process is complicated, so you should weigh the benefits and drawbacks carefully before making a final decision. Despite the advantages, marrying your spouse may mean giving up some federal student loan benefits. In the end, it’s best to keep your loans separate if your debt consolidation options include this option.

However, if you’ve recently separated or divorced your spouse, you may want to consider a joint consolidation loan. Taking out a loan jointly with your spouse may seem like a good idea, but you may not want to be stuck in a long-term financial bind. This arrangement can also lead to difficulties when it comes time to repay the loan. If you want to avoid this problem, consider finding a co-signer to make the consolidation loan.