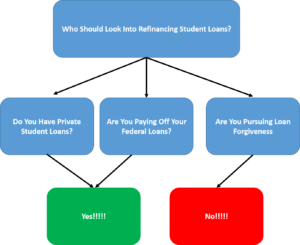

If you want to consolidate your student loans, there are several things that you need to know. The first is that if you have federal loans and private loans, you should consider refinancing. Here are some steps to make this process as smooth as possible. Rates will vary depending on your credit score, debt-to-income ratio, and other factors. To get started, fill out an application for a student loan consolidation loan.

Income-driven repayment plan

If you’re trying to pay off your student loans with an income-driven repayment plan, it’s important to understand how it works. This type of loan repayment plan is designed to adjust payments based on your income and family size. The only catch is that you have to recertify your income and family size on an annual basis. In addition, you’ll need to update your loan servicer on your income and family size every year.

The main difference between an income-driven repayment plan and an income-driven plan is that the monthly payment is based on your income and your family size. You’ll make payments that are typically between ten to twenty percent of your monthly discretionary income. However, you may qualify for a zero-dollar payment plan as long as you meet certain income requirements. The repayment term for IDR plans can be as long as twenty or 25 years, and at the end of the repayment period, the remaining balance is wiped away. This repayment plan includes periods of hardship deferment, which count as a part of the repayment term.

Lower monthly payments

Consolidating your student loans is a great way to simplify your repayment plan and reduce your monthly payments. You can choose a lower interest rate or opt for a longer repayment term. However, the disadvantage of combining student loans with private lenders is that you won’t be able to take advantage of federal loan forgiveness or cancellation programs. However, if you’re still in school, consolidation may be the right option for you.

While you should never make the mistake of consolidating your federal student loans into a private loan, you can get the same benefits as if you were consolidating them under one federal loan. One of these benefits is that your interest rate is fixed. By consolidating your federal loans, you will be able to take advantage of the income-based repayment plan. This option is good if your income is decreasing or you’re changing careers. Consolidating federal student loans also allows you to refinance at a lower rate with a private lender at a later date. Besides, refinancing is free, which may help you reduce your payments in the future.

Access to Public Service Loan Forgiveness program

Depending on your situation, you may be eligible for the Public Service Loan Forgiveness program to consolidates your student loans. This program offers a free debt cancellation for public service workers who make 120 qualifying payments during the first five years after graduation. This option isn’t right for all borrowers, however, and income-driven repayment plans may be a better option for you. You must also have a job with a qualified nonprofit.

The PSLF program has been around for years, but has recently undergone a revamp. While the program was plagued with mismanagement and breakdowns, it is now offering a path to relief for millions of public servants. Many borrowers, who were previously ineligible, will now be able to receive credit for years of service. But how do you apply? Read on to learn more.

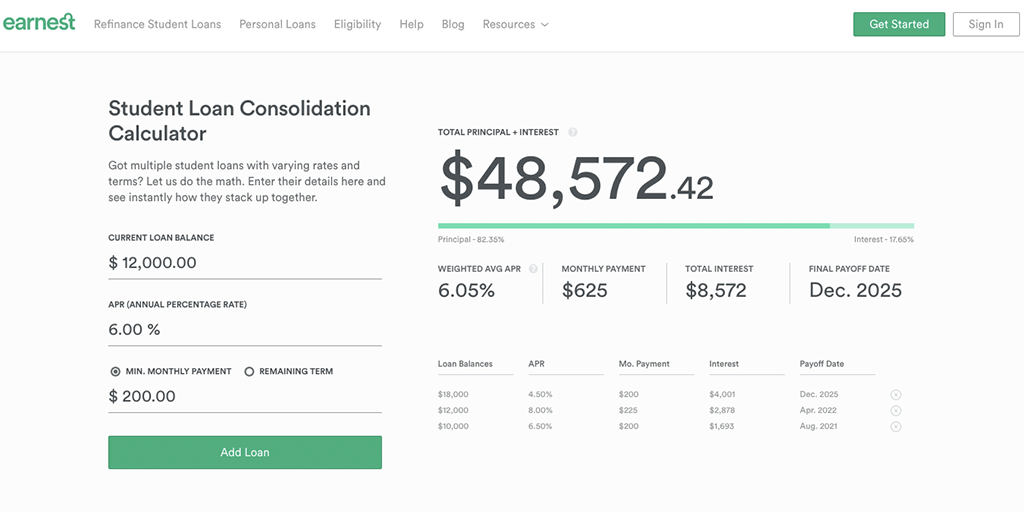

Cost of Direct Consolidation Loan

A Direct Consolidation Loan (DCL) combines federal student loans into one low monthly payment. It comes with a fixed interest rate derived by averaging the federal loan interest rates. The fixed rate is rounded up to the nearest eighth percent. You can choose the repayment term and can choose to pay the loans off over time or extend the repayment period. This loan program does not save you money, but it may be a good option if you want to qualify for federal student loan repayment programs, such as income-driven repayment, deferment, or Public Service Loan Forgiveness.

Using a Direct Consolidation Loan to consolidate student loans may seem like a good idea if you’re struggling to keep track of multiple repayment dates and loan servicers. Consolidating all your debt into a single payment makes life easier and is more affordable. By consolidating all of your student loans into one, you will only have one monthly payment to worry about. The low monthly payment and reduced interest rates will make the process easier and more convenient for you.