You have many options when it comes to where to consolidate student loans. You can choose a private or federal lender to work with. There are many ways to go about it, but you need to know exactly what you’re looking for. There are federal, private, and even bank loans to consolidate. There are many advantages and disadvantages of each, so read on to find out which one is right for you. This article will outline some of the options that are out there.

Credit unions

When deciding which lender to use for consolidation of your student loans, credit unions may be a good option. While there are some differences between credit unions and banks, you’ll likely find that both offer a competitive interest rate and flexible repayment terms. Credit unions also have better terms than banks, so they might be the best option if you have a lower credit score. Before you decide to work with a credit union, you should research the terms and eligibility requirements.

Private lenders

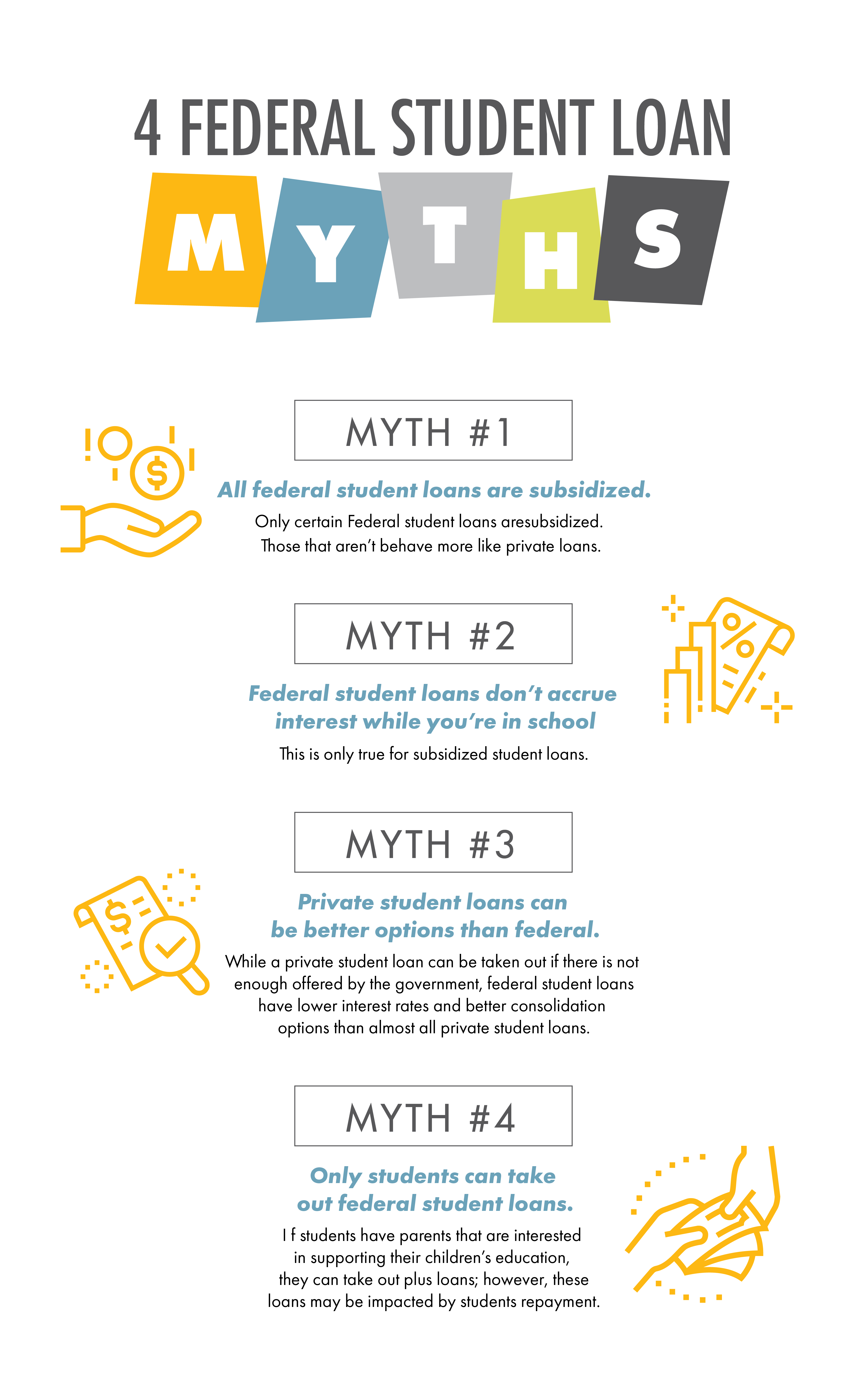

If you have multiple student loans, you may be able to reduce the total by choosing private lenders for consolidation. Private lenders for consolidation often offer new terms with a lower interest rate to reduce interest payments over the term of the loan. You can also choose a fixed or variable interest rate, release a cosigner, and choose repayment terms that work best for you. While private student loan consolidation can be a good option for you, many people find that it is not the best option for them.

Federal lenders

If you’ve already made multiple payments on a student loan but are struggling with the monthly repayments, consolidation loans may be the solution you’re looking for. A consolidation loan will allow you to consolidate all of your outstanding loans into one, resulting in a single payment that’s lower in total and easier to manage. These loans can also have longer terms. Read on to learn more about these loans and how you can find the best one for you.

Banks

Over the last decade, banks and government agencies have been fighting each other over student loan debt. But what does this mean for you? It means that you could benefit from services that help you consolidate your student loans. This article will cover some of the most important factors that you should know about student loan debt and how you can get the best deal. Also, read on to learn about some of the latest developments in the world of student loan debt.

Online lenders

While it’s possible to combine two separate loans into a single monthly payment, you need to compare the costs. Federal loans tend to be the easiest to consolidate, and they come with low interest rates and longer payback periods. Consolidating also simplifies your monthly payment by cutting out several lenders. But be sure to check your credit score and the terms of your new loan before proceeding. Also, you may need to pay higher interest rates than you had anticipated.